What is SWIFT?

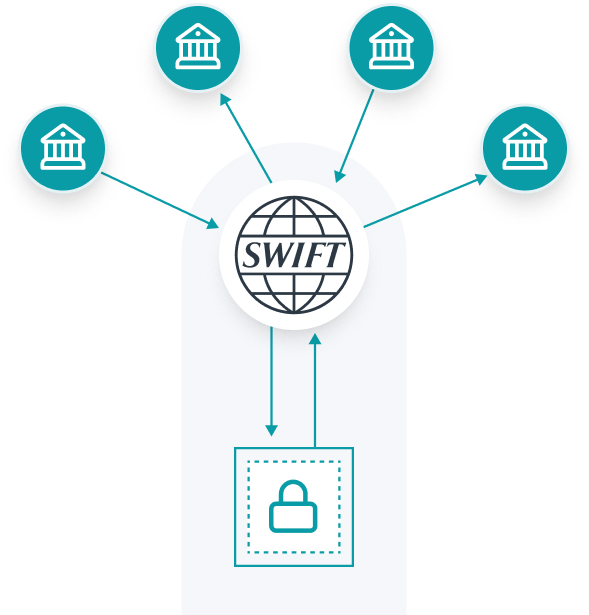

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication - a global messaging system that banks and other financial institutions use to process payments between different countries. SWIFT payments, in turn, are transactions using specific SWIFT codes to quickly, accurately, and securely transfer money overseas. The SWIFT network consists of 11,000+ financial institutions located in over 200 countries.

What is the difference between SWIFT and SEPA payments?

SWIFT and SEPA share the same goal – to provide seamless, secure, and reliable money transfers to businesses and individuals. However, SWIFT enables money transfers internationally, while SEPA payments can only be made within the SEPA zone. Moreover, SWIFT transfers can be executed in various currencies, while the SEPA initiative embraces transfers in euros only.

How long does it take to transfer money?

SWIFT transfers usually take from 1 to 4 business days. SEPA payments take from 1 to 2 business days. Please bear in mind that the transfer time also depends on time zones, currency exchange, bank holidays, etc.

Are there any euro area countries with limited access to SEPA payments?

Yes. There are some countries and jurisdictions, such as Kosovo and Montenegro (though using the Euro as their domestic currency) that do not belong to SEPA. To check whether your country is eligible to process SEPA payments, please follow the link below:

SEPA