SEPA PAYMENTS

INSTANT PAYMENT EXPERIENCE

Verifo offers the best way to make fast, reliable, and affordable payments in euros. It enables all businesses and individuals to safely and easily transfer their funds from one SEPA zone country to another.

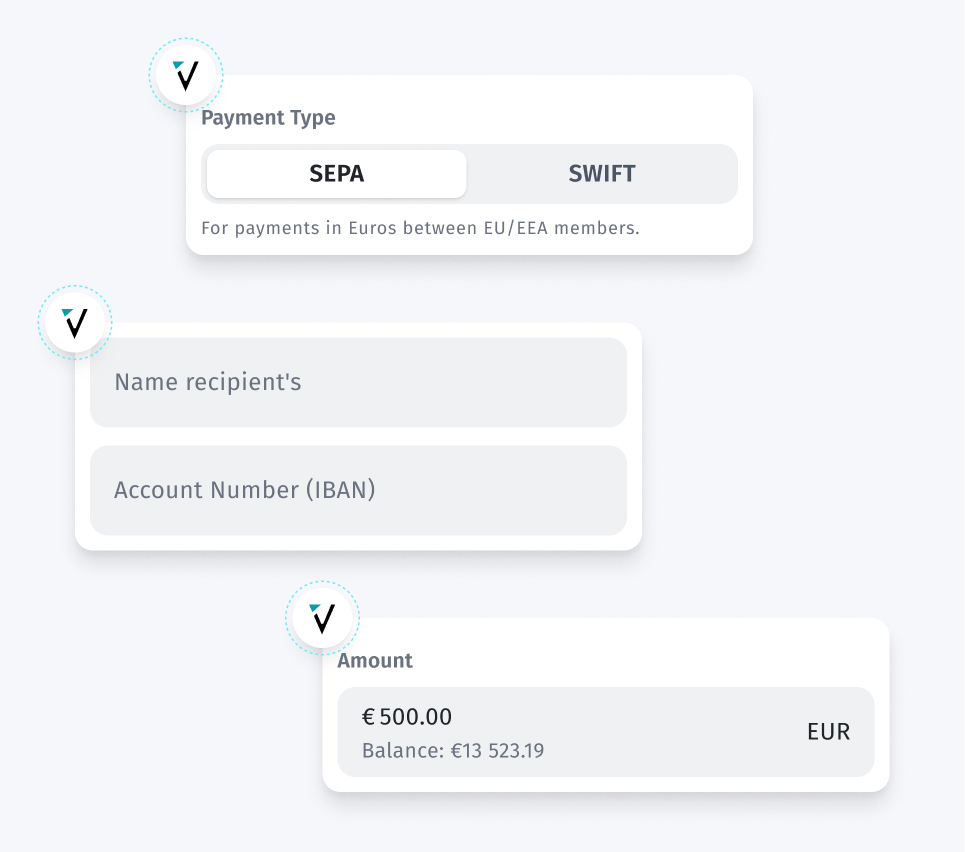

All you need is to enter the name of the person you're paying, their international bank account number (IBAN), and the amount you wish to transfer. Click 'Send,' and your transaction will be instantly completed.

Open Account Open Account Talk to sales